Our Health and Protection Plan

C2S has come together with Switch Health and National Friendly to bring members an affordable health and protection policy.

As a C2S member you benefit from an exclusive discount, helping you protect yourself and your loved ones for less.

Simple

A choice of 3 cover levels and no medical questions to answer

Affordable

Premiums start from just 27p per day

Quick to benefit from

Immediate 24/7 access to a virtual GP for the whole family Simple

Choose your level of cover

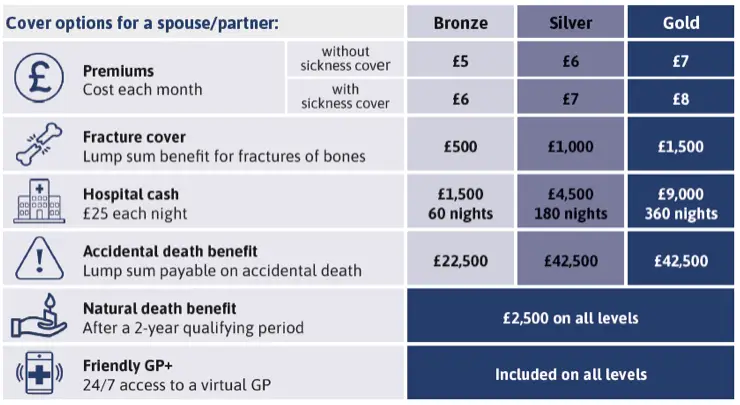

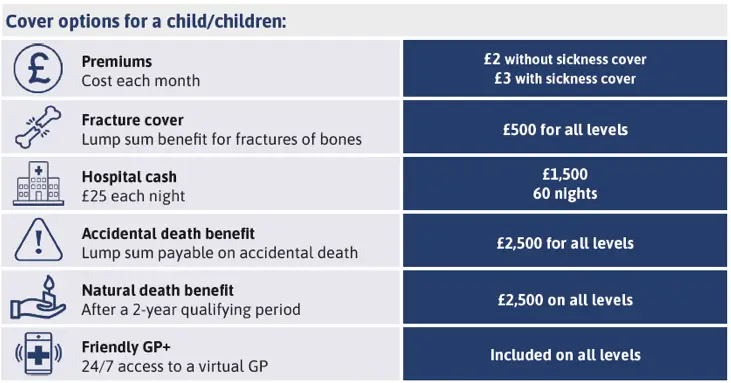

Protection for your loved ones

Hospital cash

A cash benefit per night of hospitalisation (subject to a maximum number of nights, triggered only by accidents as standard, but with option to cover sickness).

Fracture cover

A lump sum benefit for fractures of bones.

Income benefit

Short term income protection with limited benefits. 14 day waiting period and maximum 3 months payment.

Accidental death benefit

A lump sum payable upon accidental death.

Natural death benefit

A small lump sum payable on any cause of death, following a qualifying period (2-year benefit period)

Friendly GP

Access for policyholder along with partner and children.

Rehabilitation cover

£1,000 towards consultations, investigations and a list of treatments.

Sickness Benefit

option to include an income benefit should you fall ill and be unable to work, and a hospital cash benefit should you be admitted to hospital due to sickness and you need to stay overnight.

Your Benefits

The qualifying period is the period immediately following the policy start date during which claims will not be considered.

- Hospital cash benefit: First 7 days

- For sickness: N/A for the first 9 months

- Fracture cover: First 7 days

- Income benefit: First 7 days

- Accidental death benefit: None

- Natural death benefit: 2 years

- Friendly GP: From day 1

- Rehabilitation cover: first 7 days

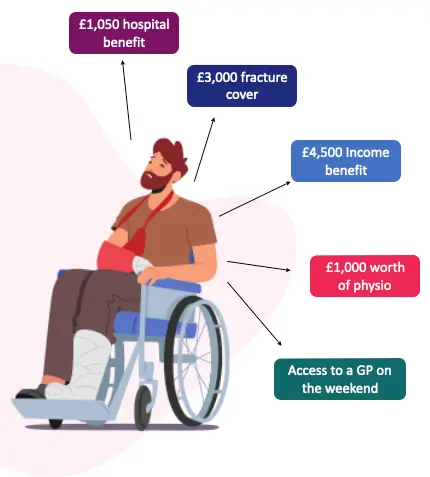

How the plan will protect you

Simon is in a road traffic accident and has Gold Level of cover. He works as a fabricator.

He is in hospital recovering for 3 weeks.

He has broken 3 ribs (minor), his arm (moderate) and knee (moderate).

Unable to work for 2 months due to his injuries.

Simon needs some physio to help with his knee before going back to work.

Due to pain medication, he is suffering badly on a Saturday with unbearable heartburn.

Value beyond financial support: Free access to Friendly GP+

Our virtual GP service is a free added benefit on these plans.

It can be accessed over the phone or online 24 hours a day, 7 days a week so your clients can always speak to a doctor when they need one.

Not only is it there to support you, but your children and partners too.

Features:

- 24/7 unlimited GP telephone consultations

- Video consultations

- Private prescriptions

- Open referrals

- Counselling

- Sick notes

- Health and wellbeing guidance and hub

- Physiotherapy

- Money and debt help

To find out more:

- Call Connor Harries on 01242 371304

- Email connor@switchhealth.co.uk

National Friendly is a trading name of National Deposit Friendly Society Limited, the manufacturer of this Friendly Shield policy. Registered office: 11-12 Queen Square, Bristol BS1 4NT. Registered in England and Wales no. 369F. National Deposit Friendly Society Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Our Financial Services Register number is 110008. You can check this at: https://register.fca.org.uk. National Deposit Friendly Society Limited is covered by the Financial Services Compensation Scheme and Financial Ombudsman Service. FS SC SH 12.24